The Facts About Insurance Agency In Jefferson Ga Uncovered

Wiki Article

3 Simple Techniques For Insurance Agency In Jefferson Ga

Table of ContentsThe 9-Second Trick For Auto Insurance Agent In Jefferson GaNot known Incorrect Statements About Business Insurance Agent In Jefferson Ga An Unbiased View of Life Insurance Agent In Jefferson GaIndicators on Auto Insurance Agent In Jefferson Ga You Need To KnowA Biased View of Insurance Agency In Jefferson GaHome Insurance Agent In Jefferson Ga Can Be Fun For Anyone

Several of one of the most typical factors for buying life insurance policy consist of: 1. Surefire security, If you have a family, a company, or others who rely on you, the life insurance policy benefit of an entire life plan serves as a financial safeguard. When you die, your recipients will certainly get a lump-sum settlement that is guaranteed to be paid completely (supplied all premiums are paid and there are no impressive financings).- Revenue substitute, Picture what would take place to your family members if the earnings you supply instantly gone away. With whole life insurance coverage, you can help make certain that your liked ones have the cash they require to assist: Pay the home loan Afford childcare, healthcare, or various other services Cover tuition or other university expenditures Remove house financial debt Preserve a family organization 3.

Your representative can aid you make a decision if any one of these motorcyclists are right for you.

The Facts About Auto Insurance Agent In Jefferson Ga Uncovered

A typical rule of thumb says your life insurance death advantage need to be worth 10 times your earnings. http://www.video-bookmark.com/bookmark/5993400/alfa-insurance---jonathan-portillo-agency/. If you have a policy (or plans) of that size, the individuals who depend on your income will certainly still have money to cover their continuous living costs.You may want a lot more if you would certainly such as to cover other significant expenses (Business Insurance Agent in Jefferson GA). You 'd such as the insurance plan to pay for your youngsters's college education and learning, so they don't require to take out pupil loans. If you have whole lots of other financial savings, you might be okay with a smaller sized life insurance coverage policy.

One factor is that people think life insurance policy is a lot more expensive than it is. As an example, 8 out of 10 Millennials overstated the price of life insurance in a 2022 study. As an example, when asked to estimate the cost of a $250,000 term life plan for a healthy and balanced 30-year-old, the bulk of survey participants presumed $1,000 per year or more.

5 Easy Facts About Insurance Agent In Jefferson Ga Explained

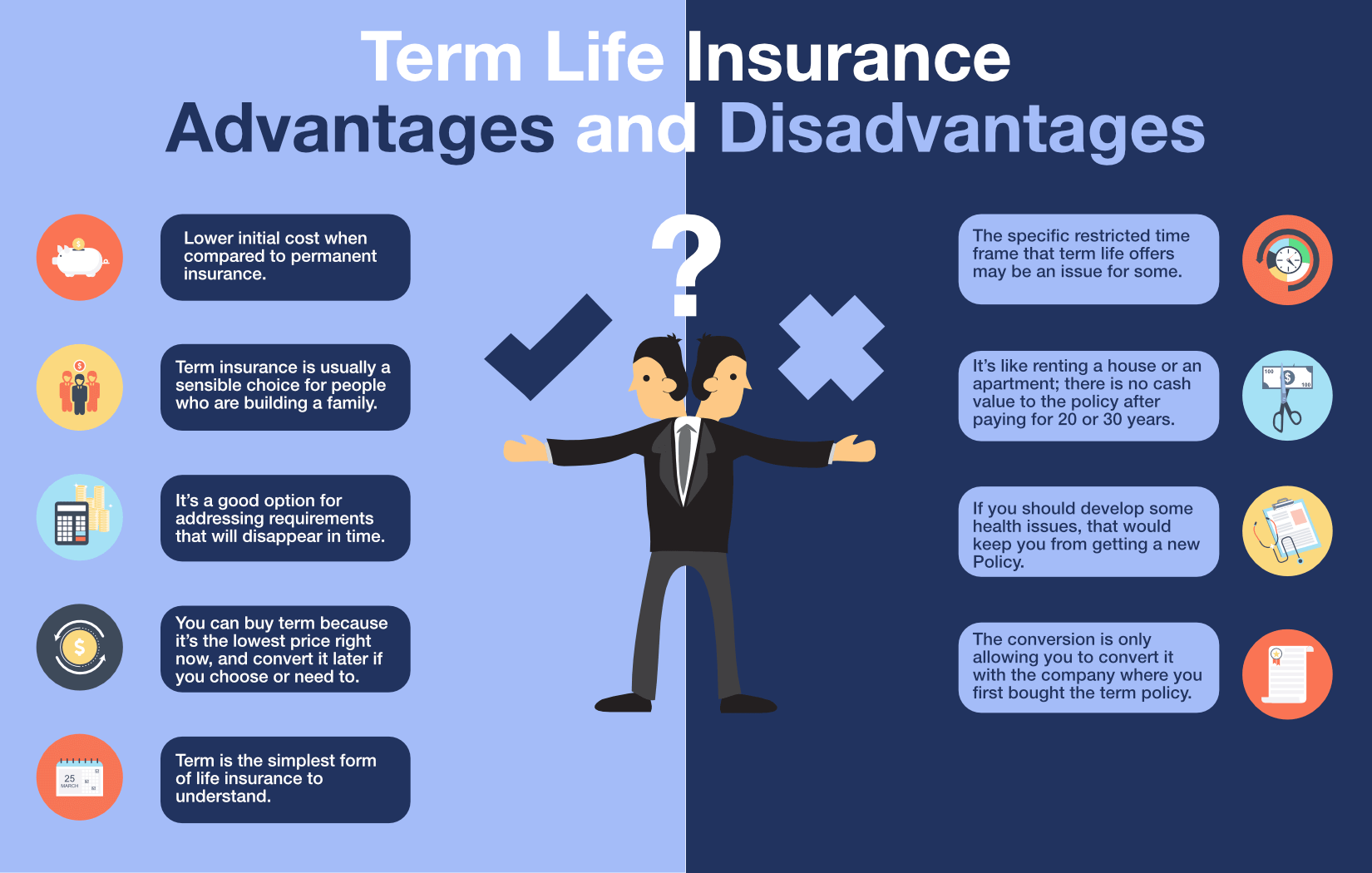

For instance, term is much more budget friendly however has an expiry date. Whole life starts setting you back extra, but can last your entire life if you keep paying the premiums. Life insurance policy covers your final costs, like a burial and funeral, when you pass away. It can pay off your debts and clinical expenses.

OGB uses two fully-insured life insurance prepare for workers and senior citizens via. The state shares of the life insurance policy costs for covered workers and senior citizens. Both strategies of life insurance policy offered, together with the equivalent quantities of dependent life insurance policy provided under each plan, are noted below.

9 Easy Facts About Life Insurance Agent In Jefferson Ga Explained

Term Life insurance policy is a pure transference of risk for the settlement of premium. Prudential, and prior carriers, have actually been offering coverage and presuming threat for the repayment of costs. In the occasion a covered individual were to pass, Prudential would honor their obligation/contract and pay the advantage.

44/month Vital Notes Freshly employed staff members that enroll within one month of employment are qualified forever insurance coverage without supplying proof of insurability. Staff members that register in the life insurance policy strategy after 1 month are required to provide evidence of insurability to the insurer. Strategy members presently registered that want to add dependent life insurance coverage for a partner can do so by supplying evidence of insurability.

Life Insurance Agent In Jefferson Ga Things To Know Before You Get This

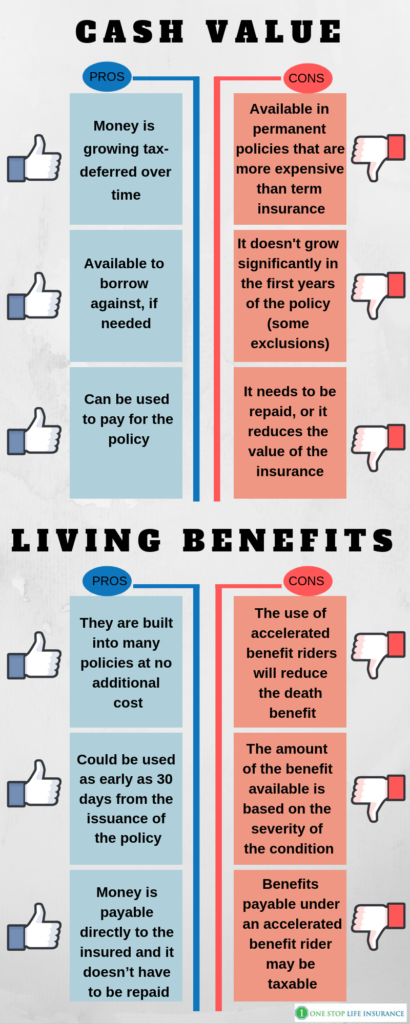

We think it is necessary to supply you with time off for leisure, recreation, or to take care of various other personal requirements. We provide time off with adaptable time off, and 12 vacations each year, containing core, regional, and/or individual holidays. We provide unique pause for other life occasions such as grief and court duty and provide a number of various other paid and unpaid fallen leaves of lack, such as adult leave, impairment leave, armed forces leave, family/medical leave, and personal leave.Policy benefits are decreased by any type of exceptional lending or financing interest and/or withdrawals. If the plan lapses, or is surrendered, any type of superior car loans taken into consideration gain in the plan may be subject to ordinary earnings taxes. https://www.twitch.tv/jonfromalfa1/about.

The cash money surrender worth, lending value and fatality proceeds payable will be lowered by any type of lien superior as a result of the repayment of an accelerated advantage under this biker. The accelerated benefits in the first year reflect deduction of a single $250 management charge, indexed at a rising cost of living price of 3% each year to the price of acceleration.

Facts About Business Insurance Agent In Jefferson Ga Uncovered

A Waiver of Costs motorcyclist forgoes the commitment for the policyholder to pay additional costs must she or he end up being entirely disabled continuously for at the very least six months. This motorcyclist will certainly sustain an extra expense. See policy agreement for added details and requirements.

The advantages of auto insurance coverage abound, especially if you are associated with a mishap. Without insurance coverage, you pay directory for damages expense and browse the after-effects by yourself - https://dzone.com/users/5015615/jonfromalfa1.html. If you've ever been associated with an automobile mishap, you recognize how laborious and time-consuming the entire results can be

Report this wiki page